OFFICE OF HYDROGEN POWER SOUTH AUSTRALIA

Wakefield House

Level 4, 277 Wakefield House, Adelaide SA 5000

Contact phone number: (08) 7085 1750

Contact email: ohpsa.enquiries@sa.gov.au

ISSN: 2653-5432

Date presented to Minister: 29 September 2023

To: Honourable Tom Koutsantonis MP

Minister for Infrastructure and Transport

Minister for Energy and Mining

Leader of Government Business

This annual report will be presented to Parliament to meet the statutory reporting requirements of (Public Sector Act 2009 (Part 3, s 12) and the Public Sector Regulations 2010 (Part 2, reg 7) and the requirements of Premier and Cabinet Circular PC013 Annual Reporting.

This report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Submitted on behalf of the OFFICE OF HYDROGEN POWER SOUTH AUSTRALIA by:

Sam Crafter

Chief Executive

Date 27/09/2023

From the Chief Executive

The 2022-23 year marked the first full year of operations for the Office of Hydrogen Power SA (OHPSA), which was established in May 2022 to oversee delivery of the Hydrogen Jobs Plan, a key priority for the South Australian government.

It has been a productive year, which not only saw significant progress against this project, but also the responsibilities of the office expand, to create a lead unit for the South Australian government’s broader hydrogen industry ambitions and to drive the growth of South Australia’s emerging hydrogen economy.

Through OHPSA, the South Australian government is making a once-in-a-generation investment to leverage the state’s abundant renewable wind and solar resources with a view to becoming a global leader in green hydrogen and green minerals.

The Hydrogen Jobs Plan ensures South Australia is on the hydrogen map internationally, with first mover advantage presenting significant hydrogen supply chain and export development opportunities.

In 2022-23, we concluded a market sounding process in relation to the Hydrogen Jobs Plan, which elicited 60 responses from across industry. We held more than 30 meetings with industry and other stakeholders to discuss their responses.

This intensive industry engagement informed the detailed work undertaken to prepare and release the Hydrogen Jobs Plan Request for Proposals (RfP) to market in late 2022.

The RfP, which closed in March 2023, sought submissions to deliver against the minimum project requirements, but also encouraged industry to put forward opportunities or alternative options that leverage further benefits for our state. We ensured the process was flexible enough to allow industry to propose innovative solutions that matched the government’s ambitious commitment.

The process attracted major interest from around the world, with 29 submissions received from local, national and global organisations.

Detailed evaluation of submissions is being led by a multi-disciplinary team with a view to awarding contracts later this year.

On 1 March 2023, our office expanded to include the Port Bonython Hydrogen Hub team (previously housed within the Department of Treasury and Finance) and established a new Hydrogen Industry Development team.

The Port Bonython Hydrogen Hub is set to be South Australia’s first large-scale clean hydrogen production precinct and is an integral part of the state’s early mover strategy to enter the global hydrogen market. The projects proposed at the Port Bonython precinct represent a multi-billion-dollar investment that could generate as much as 1.8 million tonnes of hydrogen annually by 2030.

Development agreements, which provide a pathway to land tenure, have been provided to project partners and are expected to be finalised by the end of 2023. Additionally, master-planning led by OHPSA in collaboration with its project partners commenced in April 2023 for an expected period of 18 months. The master-planning process is anticipated to support the development of common user infrastructure solutions such as pipelines, tank storage, marine export infrastructure and precinct enabling infrastructure.

Our industry development team is providing a ‘front door’ to government for the hydrogen industry to accelerate development of the state’s hydrogen sector and to provide access to government for industry partners looking for hydrogen opportunities in South Australia. Since 1 March 2023, the team has met with more than 30 industry proponents on proposed hydrogen projects in South Australia. This provides an indication of the significant level of interest in South Australia as a hydrogen investment destination.

Community engagement is a key priority for OHPSA, and community support will be critical to the success of our projects. The OHPSA team is focussed on building strong community support and social acceptance as the Hydrogen Jobs Plan and Port Bonython Hydrogen Hub projects progress.

We acknowledge the essential role that Aboriginal people play in the South Australia’s emerging hydrogen industry as land managers, heritage custodians, business owners and community leaders.

Relationships with the Barngarla people, as the Traditional Owners of land in and around the Whyalla area, are of the highest priority and we are continuing to work closely with the Barngarla Determination Aboriginal Corporation (BDAC) and Barngarla community as the projects develop.

The South Australian Economic Statement identifies that our renewable energy capacity and significant investment in hydrogen production provides a new opportunity to transform our economy and achieve our climate goals.

South Australia is poised to take the next steps in this extraordinary transition, and we are proud to be part of the South Australian government’s aspirations to capitalise on the global green transition and continue to foster a green transformation of the South Australian economy.

Sam Crafter

Chief Executive

Office of Hydrogen Power South Australia

Contents

Legislation administered by the agency

Other related agencies (within the Minister’s area/s of responsibility)

Agency specific objectives and performance

Employment opportunity programs

Agency performance management and development systems

Work health, safety and return to work programs

Executive employment in the agency

Financial performance at a glance

Strategies implemented to control and prevent fraud

Reporting required under any other act or regulation

Number of public complaints reported

Appendix: Audited financial statements 2022-23

Overview: about the agency

Our strategic focus

| Our Purpose | Enabling the growth of South Australia’s hydrogen economy. |

|---|---|

| Our Vision | A thriving and globally competitive hydrogen industry in South Australia. |

| Our Values | Service; professionalism; trust; respect; collaboration and engagement; honesty and integrity; courage and tenacity; sustainability. |

| Our functions, objectives and deliverables | Lead the South Australian government’s vision for a thriving hydrogen industry in South Australia. Deliver the Hydrogen Jobs Plan in a way that ensures the greatest outcomes and opportunities for South Australia. Work with project partners to deliver South Australia’s first large-scale clean hydrogen production precinct for both export and domestic markets at Port Bonython. Develop a hydrogen export strategy for South Australia. Establish ‘Hydrogen Power SA’, a government business enterprise to own and operate the South Australia government’s hydrogen assets. |

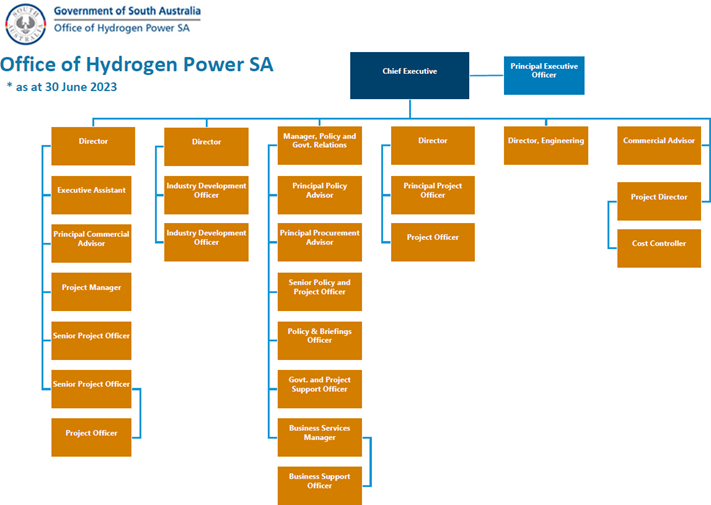

Our organisational structure

Changes to the agency

During 2022-23 there were the following changes to the agency’s structure and objectives as a result of internal reviews or machinery of government changes:

- From 1 March 2023, OHPSA was expanded to incorporate:

- the Port Bonython Hydrogen Hub project team (12 positions) from the Department of Treasury and Finance (DTF).

- the Hydrogen Industry Development team (3 positions) from the Department for Energy and Mining (DEM).

This resulted in an expansion of OHPSA’s remit from delivery of the Hydrogen Jobs Plan to a broader focus on the South Australian government’s ambitions to foster growth in South Australia’s hydrogen industry, and to capitalise on first mover advantages in the hydrogen economy.

Our Minister

Tom has been the Member of Parliament for the seat of West Torrens since 1997 and is currently Minister for Infrastructure and Transport, Minister for Energy and Mining and the Leader of Government Business in the House of Assembly.

Tom previously held ministerial appointments for Transport and Infrastructure between 2013 and 2014 and Mineral Resources and Energy between 2011 and 2018. He was also responsible for these portfolios in the Shadow Ministry between 2018 and 2022.

Our executive team

Sam Crafter

Chief Executive, Office of Hydrogen Power South Australia

Sam was appointed to the role of Chief Executive, Office of Hydrogen Power South Australia in May 2022. Sam has had an extensive career in project implementation, commercial advisory, public affairs, communications and reputation management in both the public and private sector, with a focus on the energy resources industries.

As Executive Director, Energy Implementation, with the South Australian government he led a high performing team that has managed the design and implementation of key South Australian government energy initiatives, including the world’s largest battery (Hornsdale Power Reserve), the $100 million Home Battery Scheme, the $50 million Grid Scale Storage Fund and South Australia’s Virtual Power Plant using public housing stock.

Martin Reid

Director, Land, Environment and Approvals

Martin is responsible for land, environment and approvals within the Office of Hydrogen Power South Australia. Prior to this role he led the South Australian government’s COVID response for the mining, oil, gas and energy sectors, and spent more than a decade as Director, Mining Projects with DEM, building on a career focused on project management and effective regulation across multiple sectors.

Martin has postgraduate qualifications including a Master of Business Administration and Master of Project Management, as well as degrees in economics and sociology. He is also a graduate of the Australian Institute of Company Directors and the Royal Military College Duntroon as an Army Reserve Officer.

David Penov

Director, Commercial Projects

Since joining the South Australian government in 2007, David has been employed in a number of leadership roles in the Department of Treasury and Finance and Office of Hydrogen Power South Australia. David has contributed to a number of successful significant state initiatives, including the new Royal Adelaide Hospital Project and South Australia’s Land Services Commercialisation. David is currently leading the Program Delivery function for the Hydrogen Jobs Plan and Port Bonython Hydrogen Hub Projects. David’s educational background includes Commerce (Management and Marketing) and Project Management.

Richard Day

Director, Industry Development

Richard joined the South Australian government in 2001 and since that time has worked across the energy, climate change and industry portfolios. Since 2016 his mission has been to capture the economic growth and decarbonisation opportunities associated with South Australia’s clean energy transformation towards net 100 per cent renewables, as well as sharing this story with the world.

Richard’s achievements include spearheading the development of South Australia’s inaugural Hydrogen Roadmap, Hydrogen Action Plan, Hydrogen Export Modelling Tool, overseeing the implementation of the Renewable Technology Fund and the development of the state’s Electric Vehicle Action Plan as well as co-leading the bid team to successfully attract the Australian International Renewable Energy Conference to Adelaide in April 2024.

In March 2023 Richard joined the Office of Hydrogen Power South Australia in the role of Director, Industry Development.

Sean Moules

Director, Engineering

Sean is an experienced senior Director with 30 years’ experience in major project, program and portfolio management positions spanning the government, industrial, utilities, construction and aerospace sectors.

Sean has delivered multiple programs up to $21 billion in value and has managed major industrial and manufacturing facilities, as well as delivering projects ranging from major construction to mining, utilities, restructuring, ICT, industrial automation and security.

Legislation administered by the agency

OHPSA does not administer any legislation.

Other related agencies (within the Minister’s area/s of responsibility)

OHPSA is an attached office to the Department for Energy and Mining.

The agency’s performance

Performance at a glance

During this first full reporting year, OHPSA has delivered against several critical milestones for the Hydrogen Jobs Plan project, which is a priority project for the South Australian government.

Following a "market sounding” process in late 2021-22, OHPSA undertook significant industry engagement and detailed analysis of technology and delivery options for the project.

This extensive market research informed the development of the Hydrogen Jobs Plan Request for Proposals (RfP), which was released to market in December 2022.

The RfP sought hydrogen industry partners to help deliver the government’s $593 million Hydrogen Jobs Plan and asked for proposals against a defined project scope that would deliver a 250 megawatt hydrogen production facility, 200 megawatt hydrogen power plant and associated hydrogen storage infrastructure in the Whyalla area by December 2025.

The RfP was designed to foster collaboration with industry, and encouraged alternative proposals that could bring forward additional benefits such as further hydrogen investment and high-value green jobs for South Australians.

OHPSA delivered several briefing sessions while the RfP was open to provide industry with a greater understanding of the procurement process, as well as information about the opportunity to partner with government on the delivery of this world-leading project.

Potential proponents were also provided the opportunity to visit Whyalla to view the three sites included in the RfP as potential project locations.

OHPSA has worked closely with Whyalla City Council and Barngarla Determination Aboriginal Corporation (BDAC) and broader Barngarla community to secure these sites, all located within a 15 km radius to the north-east of Whyalla and close to critical infrastructure and transport nodes. RfP respondents were also able to propose alternative sites for delivery of the project.

The RfP, which closed on 14 March 2023, garnered strong global interest, with 29 proposals received from local, national and international organisations. The proposals tendered included representations from major renewable energy companies, equipment manufacturers and technology providers.

A multidisciplinary evaluation panel has been established and continued its assessment throughout the remainder of the 2022-23 financial year.

OHPSA is simultaneously working with key stakeholders to ensure the enabling infrastructure is in place to support project delivery. This includes working with Electranet in relation to electricity infrastructure and connections, and SA Water for water infrastructure and supply. The electricity and water connection processes are on track, with commissioning anticipated in late 2025.

In March 2023, OHPSA’s role expanded to become the lead government unit to deliver on the South Australian government’s broader hydrogen ambitions, to maximise the opportunities presented by the growing demand for hydrogen globally, and to ensure South Australia obtains the largest possible share in Australia’s emerging hydrogen industry.

This includes overseeing the Port Bonython Hydrogen Hub project, and the establishment of a hydrogen industry development team within OHPSA.

The Port Bonython Hydrogen Hub is set to become South Australia’s first large-scale clean hydrogen production precinct for both export and domestic markets. It is an integral part of the state’s first mover strategy to enter the global hydrogen market.

Proposed private sector developments will be capable of providing local industry with a renewable energy source, helping to grow jobs in the region by supporting the development of sustainable industry and attracting new business development.

Development Agreements have been issued and provide a pathway to land tenure (lease of the land) for project partners and are expected to be finalised by the end of 2023.

Master planning for the hub commenced in April 2023, and is anticipated to take approximately 18 months. The masterplan will support the development of common user infrastructure at Port Bonython and will include investment and planning pathways for precinct development. The masterplan will be an important tool to help guide decision-making in relation to the hub and will provide project partners with clarity around precinct design and common user infrastructure.

The Australian Government has also confirmed its commitment to enter into a grant agreement with the South Australian government, with matched grant funding awarded to facilitate the development of hydrogen supply chain common user infrastructure. OHPSA and the Australian Government are working collaboratively to finalise the grant funding agreement.

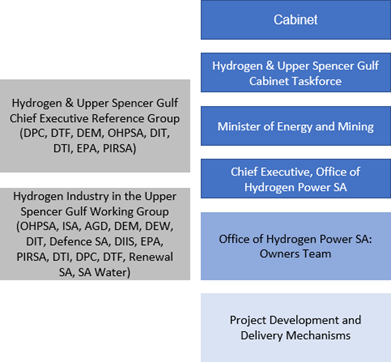

OHPSA has established a Hydrogen Industry in the Upper Spencer Gulf Working Group and Hydrogen and Upper Spencer Gulf Chief Executive Reference Group which enables cross-government collaboration to support the delivery of the Upper Spencer Gulf initiatives.

Regular project updates are provided to the Hydrogen and Upper Spencer Gulf Cabinet Taskforce which provides oversight and seeks to ensure South Australia has the optimal settings in place to seize its first-mover advantage and maximise the opportunities presented by the transition to a net zero economy.

OHPSA’s governance arrangements are displayed in the below graphic:

The hydrogen industry development function has been established in OHPSA with a remit to provide a ‘front door’ to government for the hydrogen industry to accelerate development of the state’s hydrogen sector.

Since its establishment, the industry development team has been building relationships with key stakeholders across the hydrogen value chain. This engagement is informing the development of a knowledge centre of hydrogen-related industry activity, which is being used to inform government strategy, policy, planning, communications and international engagement.

OHPSA is working closely with agencies across government to engage with proponents on hydrogen industry development, to understand the critical success factors and ensure state agency collaboration and planning to support the growth of South Australia’s emerging hydrogen industry.

OHPSA continues to work with key agencies to develop a Hydrogen Export Strategy for South Australia, which will be delivered during 2023-24. The Hydrogen Export Strategy is expected to deliver recommendations that will inform government decision making and actions to support South Australia’s emerging hydrogen industry.

During 2022-23, OHPSA’s Chief Executive, as well as other members of the team, represented South Australia at several significant global hydrogen events in Australia and abroad, including the World Hydrogen Summit in Rotterdam in May 2023. This is a leading global platform for the hydrogen industry, with around 8,000 delegates from around the world.

Attendance at these events provided invaluable opportunities for direct interaction with investors and key stakeholders to promote South Australia’s leadership in building hydrogen production capability for both the domestic industry and export markets.

Community support is critical to the success of hydrogen projects in the Upper Spencer Gulf. OHPSA is committed to engaging with communities and industries with an interest in the Hydrogen Jobs Plan and Port Bonython Hub projects as we recognise the huge economic development opportunities these projects present to the region. Information about the projects and hydrogen more broadly is shared at community events and forums, and OHPSA looks forward to increasing its presence in the region as these projects enter into the development and construction phases.

OHPSA regularly engaged with the Whyalla, Port Augusta and Port Pirie councils, as well as the Spencer Gulf Cities group, as key stakeholders in the region, while establishing a Sustainable Development Forum to give assurance to local communities and industry that we will work to protect their environment.

OHPSA recognises that these projects impact on Aboriginal country, and we met regularly with the Barngarla people as the Traditional Owners of the land in and around Whyalla.

OHPSA’s Chief Executive has been closely involved in the South Australian Aboriginal Renewable Energy Forums which have been held in Port Augusta and seek to ensure informed, early and ongoing participation of Aboriginal people to support South Australia’s energy transition and net-zero emissions future.

Agency specific objectives and performance

| Agency objectives | Indicators | Performance |

|---|---|---|

| Oversee delivery of the Hydrogen Jobs Plan. |

Construction of a:

in the Whyalla area by December 2025. |

RfP released to market in 2022 with evaluation currently underway.

Contracts with successful project partners anticipated for Q4 2023. Water and electricity connections on track. |

| Development of a Hydrogen Export Strategy for South Australia. | Finalisation and release of a hydrogen export strategy. | OHPSA is working with key agencies on the development of the Hydrogen Export Strategy. Release anticipated in 2023-24. |

| Establish Hydrogen Power SA as a government business enterprise. | Hydrogen Power South Australia is established. | Economic and strategic assessments are underway to support this work. |

| Facilitate growth in South Australia’s hydrogen industry. | Establish a ‘front door’ to government for hydrogen industry stakeholders and establish linkages to appropriate government facilitators. | High level of engagement with hydrogen industry proponents. |

| Facilitate the design of a multi-party port Bonython Hydrogen export hub with private sector project partners. |

Development of a Master Plan for the Common Use Infrastructure (CUI) at Port Bonython.

Progression of project partners hydrogen projects at Port Bonython by way of state support. |

Regular engagement with project partners and stakeholders to inform the master plan.

Commencement of optioneering process for CUI which will continue into 2023-24. |

Corporate performance summary

The majority of the corporate services for OHPSA are provided by the Department for Energy and Mining through a Service Level Agreement.

Employment opportunity programs

| Program name | Performance |

|---|---|

| N/A | N/A |

Agency performance management and development systems

| Performance management and development system | Performance |

|---|---|

A performance management and development framework within the agency supports employees and leaders to create performance development plans and have regular performance conversations. All discussions are recorded in this online system and at appropriate periods an audit is undertaken on completion rates. | Staff participate in two formal performance management and development plan conversations each year.

The agency’s performance management and development framework uses the iGROW online platform.

As of 30 June 2023, OHPSA’s participation was 4.3 per cent. This reflects the fact that a large number of team members joined OHPSA within the last quarter of the year. OHPSA, through DEM, has established training sessions to improve staff participation and will champion the process over the coming year. |

Work health, safety and return to work programs

| Program name | Performance |

|---|---|

| Wellbeing initiatives |

OHPSA, through DEM, provides numerous initiatives to support employee wellbeing in the areas of career, social, financial, physical, community and mental. These include:

Flu Vaccination Program Flu vaccinations were offered to all staff via onsite clinics or pharmacy vouchers. Corporate Cup Annual staff sponsorship in the Corporate Cup recognises that physical activity promotes health and wellbeing while building positive behaviour and a strong team culture. Flexible Working From March 2023, a 12-month extension of working from home agreements was established. |

| Employee Assistance Program | OHPSA, through DEM, offers staff access to free, confidential counselling and support services through offsite Employee Assistance Program appointments. |

| Work Health Safety and Injury Management (WHSIM) Framework |

OHPSA, through DEM, abides by the WHSIM Framework which is a set of policies, procedures and guides that strengthen our ability to improve wellbeing and safety.

OHPSA has undertaken a Worksite Hazard Identification exercise to assist with identifying the offices risk profile. In 2022-23, the framework was enhanced to ensure it continues to reflect the offices risk profile. Additional documents added to the framework included:

Working Alone, in Isolation or Remote Guide. |

| Workplace injury claims | 2022-23 | 2021-22 | % Change (+ / -) |

|---|---|---|---|

| Total new workplace injury claims | 0 | 0 | N/A |

| Fatalities | 0 | 0 | N/A |

| Seriously injured workers* | 0 | 0 | N/A |

| Significant injuries (where lost time exceeds a working week, expressed as frequency rate per 1000 FTE) | 0 | 0 | N/A |

*number of claimants assessed during the reporting period as having a whole person impairment of 30% or more under the Return to Work Act 2014 (Part 2 Division 5)

| Work health and safety regulations | 2022-23 | 2021-22 | % Change (+ / -) |

|---|---|---|---|

| Number of notifiable incidents (Work Health and Safety Act 2012, Part 3) | 0 | 0 | N/A |

| Number of provisional improvement, improvement and prohibition notices (Work Health and Safety Act 2012 Sections 90, 191 and 195) | 0 | 0 | N/A |

| Return to work costs** | 2022-23 | 2021-22 | % Change (+ / -) |

|---|---|---|---|

| Total gross workers compensation expenditure ($) | 0 | 0 | N/A |

| Income support payments – gross ($) | 0 | 0 | N/A |

Executive employment in the agency

| Executive classification | Number of executives |

|---|---|

| EXECF | 1 |

| SAES2 | 0 |

| SAES1 | 4 |

Data for previous years is available at: 2021-2022 OHPSA Annual Report

The Office of the Commissioner for Public Sector Employment has a workforce information page that provides further information on the breakdown of executive gender, salary and tenure by agency.

Financial performance

Financial performance at a glance

The following is a brief summary of the overall financial position of the agency. Full audited financial statements for 2022-2023 are attached to this report.

| Statement of Comprehensive Income | 2022-23 Budget $000s | 2022-23 Actual $000s | Variation $000s | 2021-22 Actual $000s |

|---|---|---|---|---|

| Total Income | 12,024 | 12,918 | (894) | 113 |

| Total Expenses | 6,584 | 12,903 | (6,319) | 118 |

| Net Result | 5,440 | 15 | 5,425 | (5) |

| Total Comprehensive Result | 5,440 | 15 | 5,425 | (5) |

The higher than budgeted expenditure is due predominantly to the Machinery of Government changes which transferred the responsibility for the Port Bonython Hydrogen Hub to OHPSA and costs related to the Hydrogen Jobs Plan.

| Statement of Financial Position | 2022-23 Budget $000s | 2022-23 Actual $000s | Variation $000s | 2021-22 Actual $000s |

|---|---|---|---|---|

| Current assets | 4,531 | 5,518 | (987) | 31 |

| Non-current assets | 940 | - | 940 | - |

| Total assets | 5,471 | 5,518 | (47) | 31 |

| Current liabilities | 35 | 5,413 | (5,378) | 36 |

| Non-current liabilities | 1 | 576 | (575) | - |

| Total liabilities | 36 | 5,989 | (5,953) | 36 |

| Net assets | 5,435 | (471) | 5,906 | (5) |

| Equity | 5,435 | (471) | 5,906 | (5) |

The higher than budgeted total liabilities reflects the balance of invoices received for work undertaken during 2022-23 which will be paid during 2023-24 and the establishment of employee provisions for the office’s first full year of operations.

Consultants disclosure

The following is a summary of external consultants that have been engaged by the agency, the nature of work undertaken, and the actual payments made for the work undertaken during the financial year.

Consultancies with a contract value below $10,000 each

| Consultancies | Purpose | $ Actual payment |

|---|---|---|

| All consultancies below $10,000 each – combined | Various | 19,712 |

Consultancies with a contract value above $10,000 each

| Consultancies | Purpose | $ Actual payment |

|---|---|---|

| AECOM Australia | Preliminary noise assessment | 38,032 |

| AM Environmental Consulting | Environmental assessments | 30,000 |

| BDO Services Pty Ltd | Hydrogen Jobs Plan probity advisory services | 185,363 |

| BDO Services Pty Ltd | Probity, advisory and consultancy services for the Hydrogen Jobs Plan project | 14,774 |

| Duck and Partners Pty Ltd | Management consultancy services to support operational and project delivery optimisation | 17,200 |

| Electranet Pty Ltd | Upper Spencer Gulf projects connection investigations and advice | 103,450 |

| Frontier Economics Pty Ltd | Energy market analysis and advice | 314,472 |

| Frontier Economics Pty Ltd | Energy market modelling relating to the Hydrogen Jobs Plan | 45,250 |

| GHD Pty Ltd | Specialised advice relating to land transfers | 346,684 |

| GPA Engineering Pty Ltd | Expert engineering, technical, risk and risk services to support Hydrogen Jobs Plan delivery | 676,984 |

| Inside Infrastructure Pty Ltd | Advice on water supply solutions | 50,000 |

| KPMG Australia | Economic analysis, business development and commercial advisory services to support Hydrogen Jobs Plan delivery | 689,467 |

| O’Connor Marsden & Assoc P/L | Probity services for the Port Bonython Hydrogen Hub project | 26,068 |

| Prudentia Process Consulting | Early engineering advice and support | 97,260 |

| Total | 2,635,004 |

Data for previous years is available at: 2021-2022 OHPSA Annual Report.

See also the Consolidated Financial Report of the Department of Treasury and Finance for total value of consultancy contracts across the South Australian Public Sector.

Contractors disclosure

The following is a summary of external contractors that have been engaged by the agency, the nature of work undertaken, and the actual payments made for work undertaken during the financial year.

Contractors with a contract value below $10,000

Nil

Contractors with a contract value above $10,000 each

| Contractors | Purpose | $ Actual payment |

|---|---|---|

| Akera Partners Pty Ltd | Preliminary electrical connections investigation | 167,705 |

| Arcblue Consulting (Aus) P/L | Procurement advisory services | 256,971 |

| Ernst & Young | Design and development advisory services relating to the Port Bonython Project | 2,434,338 |

| Insight Global Risk | Risk management and document writing services | 71,560 |

| Joule Purpose Pty Ltd | Provision of advisory services for the Hydrogen Jobs Plan evaluation process | 96,232 |

| Knight Frank Valuations (SA) | Land valuations | 11,000 |

| McGregor Tan Research | Hydrogen development in the Upper Spencer Gulf | 27,000 |

| Opex Nominees Pty Ltd | Project management services | 1,103,968 |

| Woods Street Partners Pty Ltd | Commercial advisory services | 506,100 |

| Total | 4,674,874 |

Data for previous years is available at: 2021-2022 OHPSA Annual Report.

The details of South Australian Government-awarded contracts for goods, services, and works are displayed on the SA Tenders and Contracts website. View the agency list of contracts.

The website also provides details of across government contracts.

Risk management

Risk and audit at a glance

The former Risk and Performance Committee (a joint committee established with the Department for Industry, Innovation and Skills and the Department for Trade and Investment) was disbanded in December 2022. The role of the Risk and Performance Committee is to assist the agencies with oversight responsibilities for external financial reporting, internal control systems, risk management systems and the internal and external audit functions.

In April 2023, a new Audit and Risk Committee was established, with a similar scope, to focus on DEM and the attached OHPSA. Membership consists of both internal and external members and the Committee is independently chaired. One of the first tasks of the Committee was to improve both entities risk management framework and management of strategic risks in alignment with the government’s commitments.

The DEM Executive Leadership Team, along with OHPSA Executive representatives, continue to undertake monthly reviews of the strategic risks to ensure the risks remained current and that treatment actions are implemented with the agreed timeframe.

Other key activities during the year focused on uplifting protective and cyber security internal controls, review of procurement policies and procedures to align with the new Treasurer’s Instruction 18 – Procurement, embedding consistent risk management approach in key functions such as project management, corporate services and work health and safety.

Fraud detected in the agency

| Category/nature of fraud | Number of instances |

|---|---|

| Nil | Nil |

NB: Fraud reported includes actual and reasonably suspected incidents of fraud.

Strategies implemented to control and prevent fraud

OHPSA, through Service Level Agreements with DEM, continued to take a risk- based approach to control and prevent instances of fraud. The control framework includes fraud, corruption, misconduct and maladministration policy and procedure.

Fraud control and prevention activities during the year included:

- Annual review of financial and human resource delegations.

- Review of purchase card transactions.

- Segregation of duties for approvals and payments.

- Continued monitoring of finance and project dashboard reporting.

- Regular review of key reconciliations performed by the agency’s finance team, and Shared Services SA (including payroll, cash, accounts payable and accounts receivable).

- Monthly monitoring of divisional actual and budget expenditure.

- Six monthly review of bank account signatories and authorised officers.

- Quarterly review of Basware users (including financial authorisations).

Data for previous years is available at: 2021-2022 OHPSA Annual Report.

Public interest disclosure

Number of occasions on which public interest information has been disclosed to a responsible officer of the agency under the Public Interest Disclosure Act 2018:

0

Data for previous years is available at: 2021-2022 OHPSA Annual Report.

Note: Disclosure of public interest information was previously reported under the Whistleblowers Protection Act 1993 and repealed by the Public Interest Disclosure Act 2018 on 1/7/2019.

Reporting required under any other act or regulation

| Act or Regulation | Requirement |

|---|---|

| Nil | Nil |

Public complaints

Number of public complaints reported

| Complaint categories | Sub-categories | Example | Number of Complaints |

|---|---|---|---|

| Professional behaviour | Staff attitude | Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency | 0 |

| Professional behaviour | Staff competency | Failure to action service request; poorly informed decisions; incorrect or incomplete service provided | 0 |

| Professional behaviour | Staff knowledge | Lack of service specific knowledge; incomplete or out-of-date knowledge | 0 |

| Communication | Communication quality | Inadequate, delayed or absent communication with customer | 0 |

| Communication | Confidentiality | Customer’s confidentiality or privacy not respected; information shared incorrectly | 0 |

| Service delivery | Systems/technology | System offline; inaccessible to customer; incorrect result/information provided; poor system design | 0 |

| Service delivery | Access to services | Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities | 0 |

| Service delivery | Process | Processing error; incorrect process used; delay in processing application; process not customer responsive | 0 |

| Policy | Policy application | Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given | 0 |

| Policy | Policy content | Policy content difficult to understand; policy unreasonable or disadvantages customer | 0 |

| Service quality | Information | Incorrect, incomplete, out-dated or inadequate information; not fit for purpose | 0 |

| Service quality | Access to information | Information difficult to understand, hard to find or difficult to use; not plain English | 0 |

| Service quality | Timeliness | Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met | 0 |

| Service quality | Safety | Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness | 0 |

| Service quality | Service responsiveness | Service design doesn’t meet customer needs; poor service fit with customer expectations | 0 |

| No case to answer | No case to answer | Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate | 0 |

| Total | 0 |

Additional Metrics

| Additional Metrics | Total |

|---|---|

| Number of positive feedback comments | 0 |

| Number of negative feedback comments | 0 |

| Total number of feedback comments | 0 |

| % complaints resolved within policy timeframes | N/A |

Data for previous years is available at: 2021-2022 OHPSA Annual Report,

Service improvements

| Complaints and feedback submitted to OHPSA are being managed by DEM under a service level agreement. Complaints and feedback are registered using DEM’s complaint management system. This system has been improved with effort made to streamline the allocation of and review of complaints received to help support a positive customer experience. The department is finalising the complaints and feedback policy and procedures to consider further opportunities for service improvements. Further training is also being provided to staff. |

Compliance Statement

| OHPSA is compliant with Premier and Cabinet Circular 039 – complaint management in the South Australian public sector | Y |

| OHPSA has communicated the content of PC 039 and the agency’s related complaints policies and procedures to employees. | Y |