On this page

April 2024

Introduction

The South Australian Department for Energy and Mining (DEM) manages the State’s petroleum resources as the lead agency facilitating ecologically sustainable energy resource exploration and production. Its operations cover investment attraction through provision of geoscientific data (Geological Survey of SA), regulation through policy and legislation (DEM Regulation and Compliance Division) and royalty optimisation (DEM Corporate and Commercial Division).

What's new

New DEM organisation structure

The Department was reorganised in 2023 and the new structure is shown on Figure 1. Key contacts for the energy resource sector are largely unchanged.

Figure 1: DEM organisation chart

Energy Resources Act 2000

To maintain leading practice regulation of South Australia's petroleum, gas storage, pipeline transmission and geothermal energy industries the Department for Energy and Mining periodically reviews legislation. The Petroleum and Geothermal Energy Act 2000 (PGE Act) was last significantly reviewed and amended in 2009. A draft Bill to amend the PGE Act was introduced into Parliament in 2021, following the change in government in March 2022 a new draft Bill was prepared. The Energy Resources Act 2000 (ER Act) came into effect on 11 April 2024 and significant proposed amendments include:

- Changing the title of the PGE Act to the ‘Energy Resources Act’, to reflect the actual broader scope of the Act which now covers geothermal, natural hydrogen, underground coal gasification, carbon dioxide and carbon capture and storage (CCS).

- Modifying the definition of transmission pipeline to allow transport of manufactured hydrogen and imported substances such as LNG.

- Adding a provision to charge a rent payment for commercial geological storage of regulated substances (e.g. imported CO2 and hydrogen) via gas storage licences under the Act.

- Improving and streamlining stakeholder consultation for activity approvals.

- Introducing Ministerial approval requirement for a >20% change in control of licence or as prescribed in the regulations.

- Introducing statutory security to the Crown, so Crown has first priority over a licensee’s property in event of bankruptcy.

- Extending the existing power for the Minister to designate areas of the state as competitive tender regions.

HRE Act and Regulations

The Hydrogen and Renewable Energy Act 2023 (HRE Act) is the nation’s first legislative framework designed to provide a coordinated approach to the burgeoning hydrogen and renewable energy industries. The Hydrogen and Renewable Energy Act represents 6 Acts merged into one, minimising red tape for investors.

The HRE Act applies to both freehold and government-owned land, as well as state waters, and will ensure community and investor certainty and clarity, as well as consistently reliable performance across the social, environmental and safety aspects of the industry. On freehold land, proponents will need to secure access to land through direct agreement with landowners, preserving current arrangements.

A new competitive system applies for conferring access and licences for projects on pastoral land and state waters, enabling the government to responsibly assign access to some of the state’s most prospective areas for renewable energy development. Five licence types have been created relating to the key stages of renewable energy projects, from the early research and feasibility stage, right through to the construction, operation and closure of facilities:

- Renewable energy feasibility licence/permit – enables exploration for renewable energy, including construction of monitoring equipment

- Renewable energy infrastructure licence – permits construction, operation, decommissioning and rehabilitation of renewable energy infrastructure

- Renewable energy research licence – permits construction, operation, decommissioning and rehabilitation of renewable energy infrastructure for the purpose of researching the capabilities of a technology, system or process

- Hydrogen generation licence – permits construction, operation, decommissioning and rehabilitation of hydrogen generation facilities

- Associated infrastructure licence – permits ancillary infrastructure (transmission, roads, water treatment), and associated facilities (hydrogen power plants, ports for hydrogen product export, desalination for hydrogen production)

Consultation on the draft Hydrogen and Renewable Energy regulations closed on 15 April 2024.

Figure 2: Hydrogen and energy resources legislation framework

Nominations for acreage release areas

In early April 2024 there were five Competitive Tender Regions (CTRs) in SA (Fig. 3). The ER Act came into force on 11 April 2024 and allows the Minister to designate areas of the state as competitive tender regions. Note that CTRs do not affect existing licences and applications.

Explorers and service companies can now nominate areas for acreage releases in CTRs. Full details about how to nominate areas can be found on the DEM website.

Competitive tender now applies for:

- Petroleum Exploration Licence (PEL - Petroleum and other prescribed regulated substances),

- Regulated Substances Exploration Licence (RSEL - Petroleum and other prescribed regulated substances),

- Geothermal Exploration Licence (GEL) and

- Gas Storage Exploration Licence (GSEL).

And covers licensing and regulation of:

- Petroleum and other prescribed regulated substances (petroleum, CO2, H, H2S, He, N and substances produced with petroleum),

- Deep geothermal energy, and

- Gas storage reservoirs for regulated substances (gas, CCS, hydrogen etc.).

Figure 3: Map showing competitive tender regions

Otway Basin Petroleum Systems Model

DEM’s Petroleum Systems Modelling project has delivered a fresh look at the South Australian onshore Otway Basin, generating powerful new datasets and highlighting new oil and gas and gas storage plays. Key outcomes include:

- 6 chemo-stratigraphic sequences identified in the Crayfish Group, when integrated with seismic have improved correlations across the basin and understanding of basin fill.

- The productive Penola Trough extends westward and includes the St Clair Trough, the Tantanoola Trough is a distinct depositional centre and the Robe Trough is more extensive and deeper than previously understood.

- GDE maps have been completed and are the culmination of geological understanding in each interval with integrated results from whole of-basin well correlations, seismic horizon/fault mapping, seismic facies interpretation and core interpretation.

- Lower Sawpit (McEachern Sandstone) re-evaluation - previously regarded as terrestrial crevasse splays, it is now interpreted as lacustrine turbidites - a new exploration play.

- Potential good quality, liquids prone lacustrine source rocks are present in the Jurassic Casterton Formation, and the Early Cretaceous Lower Sawpit Shale. Poorer quality, gas prone source rocks are likely to be present in the Upper Sawpit Shale and Laira Formation.

- Modelling suggests most liquid hydrocarbons were generated/expelled from the Lower Sawpit Shale between 126 and 70Ma (Fig. 4), with the greatest volume sourced from the Penola and Robe Troughs. Gas and condensate expulsion also took place from the Upper and Lower Sawpit Shale in the Penola and Robe Troughs, with expulsion complete by around 30Ma. Gas is modelled to have been generated/expelled from the Laira Formation in the Tantanoola Trough (100Ma – present day).

- The Robe and lightly explored Tantanoola Troughs have been identified for the first time as regions of significant gas expulsion:

- DEM’s modelling reveals significant gas expulsion has occurred from the Lower & Upper Sawpit Shale in the Robe Trough.

- The Laira Formation is also generating hydrocarbons from flood plain & lake sediments. Significant generation is observed for the first time in the Tantanoola Trough.

- The model reveals that oil expulsion occurs from four intervals: Laira Formation, Upper Sawpit Shale, Lower Sawpit Shale/McEachern and Casterton Formation.

Figure 4: Modelled gas expulsion map onshore Otway Basin in South Australia

Otway Basin PSM project deliverables - available for free download:

- Petroleum systems model (PSM) – Trinity files, movies and summaries.

- Regional seismic interpretation – 14 key horizons and faults mapped and gridded.

- Chemostratigraphy based formation tops – new data for 15 wells, 80 wells picked.

- 780m of core interpretations (WellCAD dataset).

- 6 basin-wide Gross Depositional Environment (GDE) maps for key formations.

- ArcMap and Petrosys projects.

- Multiple peer-reviewed papers.

Photo: DEM staff reviewing Otway Basin core at the Tonsley Core Library in 2023

Petroleum exploration and production activity

Petroleum exploration licences

It has been possible to lodge Petroleum Exploration Licence applications (PELAs) at any time ‘over-the-counter’ over much of the state excluding the Arckaringa, Arrowie, Cooper, Otway and Polda competitive tender areas (Fig. 5). Legislative changes now provide the Minister with the ability to declare competitive tender regions elsewhere, including the entire state.

The application fee is currently A$5,174 (subject to change from 1 July 2024), applications must include a 5 year work program with at least one exploration well and evidence of the applicant’s technical and financial capacity. An option exists in PELAs where the first ranked applicant does not make timely bona fide efforts to progress their application - the first application may be refused, then the second assumes primacy (excluding PELAs with 'good faith' efforts to conclude Native Title agreements).

Vacant acreage in competitive tender areas is only available via acreage releases where applicants bid 5 year work programs. Most of the State’s prospective acreage is covered by 31 PELs (area 138,230 km2) and 82 PELAs (area 569,046 km2) as at 16 April 2024 (Fig. 5).

Figure 5: South Australian petroleum tenements

On 11 February 2021 the Petroleum and Geothermal Energy Regulations 2013 were amended to declare hydrogen, hydrogen compounds and by-products from hydrogen production to be regulated substances under the Petroleum and Geothermal Energy Act 2000 (PGE Act). Companies are able to apply to explore for natural hydrogen via a PEL and the transmission of hydrogen or compounds of hydrogen are now permissible under the transmission pipeline licencing provisions of the PGE Act.

These regulatory changes triggered over 40 ‘over the counter’ PELAs targeting natural hydrogen (Fig. 6). Areas with potential for natural hydrogen (e.g. Polda, Arrowie and Arckaringa Basins) were designated as competitive tender regions in late 2022. The first of these licences (PEL 687) over Kangaroo Island and southern Yorke Peninsula was granted to Gold Hydrogen Pty Ltd on 22 July 2021. PEL 691 was granted to H2EX on Eyre Peninsula on 15 June 2022.

Figure 6: Licences and applications targeting natural hydrogen

Information about how to apply, the licence register and maps showing current licences and applications can be accessed in the Onshore licensing section.

Photo: Drilling at Ramsay 1 on the Yorke Peninsula, October 2023

Petroleum retention and production licences

A total of 206 Petroleum Retention Licence (PRLs) have been granted over an area of 16,594 km2 and Petroleum Production Licences (PPLs) cover 7,423 km2 of the Cooper and Otway basins.

Native Title and land access

Right to Negotiate

As at April 2024, the relevant registered native title claimants/holders, petroleum explorers and the South Australian state government have concluded 55 land access agreements in relation to a total of 51 licence areas:

- 7 in the Arckaringa Basin;

- 37 in the Cooper Basin;

- 4 in the Eromanga Basin;

- 1 in the Officer Basin; and

- 2 in the Arrowie Basin.

All of these agreements cover the full cycle of petroleum activities including exploration, development and production.

Conjunctive Indigenous Land Use Agreements (ILUAs)

The following conjunctive ILUAs are in place over much of the Cooper Basin:

- In February 2007, the Yandruwandha/Yawarrawarrka people entered into the first petroleum ILUA in the South Australian Cooper Basin over approximately 40,000 km2. This agreement also represented the first conjunctive petroleum ILUA in a productive province in Australia.

- On 2 February 2012, a second conjunctive petroleum ILUA with the Wangkangurru/Yarluyandi people was registered with the National Native Title Tribunal.

To date, industry has signed on to at least 22 ILUA’s with the Yandruwandha/Yawarrawarrka and Wangkangurru/Yarluyandi people, of which 14 related to the granting of PELs in the Cooper/Eromanga Basins.

Drilling and seismic surveys

Otway Basin

No petroleum wells were drilled and no seismic acquisition occurred in 2023.

Stansbury Basin

Gold Hydrogen drilled Ramsay 1 and Ramsay 2 natural hydrogen exploration wells were drilled in late 2023.

Cooper Basin

Petroleum drilling levels remain steady with 119 wells in 2022 compared to 110 in 2023 including 11 exploration wells (Figures 7 and 8). Oil exploration successes include Beach Energy’s Bangalee South 1 and Callawonga North 1 wells (Fig. 4). Drilling of gas appraisal and development opportunities continue as the main focus in the Cooper Basin, along with 1 CO2 injector well.

As at 16 April 2024, 1 appraisal and 21 development wells have been drilled in the Cooper-Eromanga basins this year with another 4 wells currently drilling. Current success rates are shown in Table 1.

Table 1: Cooper and Eromanga basins conventional oil and gas success rates, January 2002 to 16 April 2024.

| Exploration wells drilled | 385 |

| Commercial success rate (%) | 41.2% |

| Appraisal and development wells drilled | 1271 |

Figure 7: Exploration, development and appraisal drilling statistics (all basins) 2013 to 2023.

Figure 8: Commercial oil discoveries in the SA Cooper/Eromanga basins, 1962 to 2023. Milestone discoveries are highlighted.

Discovery Energy acquired the Adidas 3D survey over part of PEL 512 in the Cooper Basin in March 2023.

Production and royalties

Cumulative petroleum production is shown in Table 2 and Figures 9-13 show sales and production trends. Detailed production data (to well and individual pool level) can be accessed via the PEPS South Australia online database.

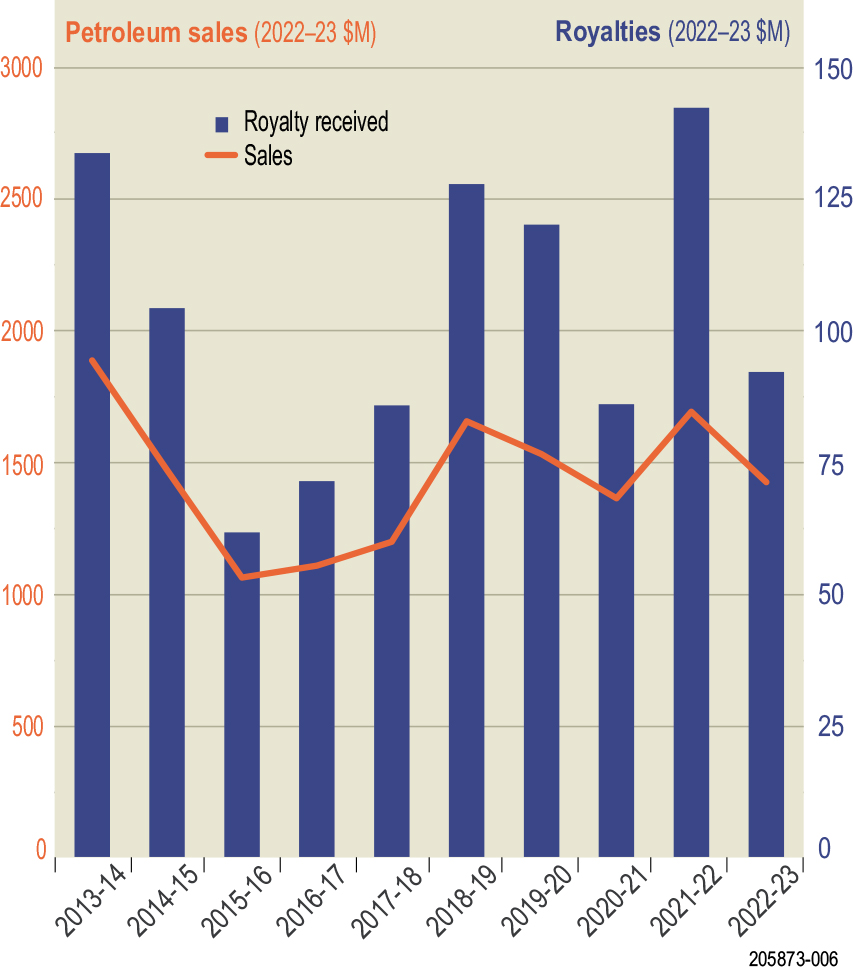

Figure 9: Petroleum sales and royalty payments, 2013–14 to 2022–23.

Petroleum royalty payments to the State in financial year 2022-23 were $92.2m, with estimated total product sales of $1.43b. This brings the cumulative royalty paid since 1970 to $4.19b (2022/23 dollars) and cumulative sales to an estimated $67.56b (2022/23 dollars). Since 1991 the average royalty paid (after allowable deductions of above-ground costs) equals 6.83% of the sales value.

Table 2. South Australian Cooper Basin production statistics.

| Cumulative Production (2022-23) | 5.77 TCF sales gas (since 1970), 244.52 mmbbl oil (from 1983), 93.1 mmboe LPG (from 1984), 89.4 mmboe condensate (from 1983) |

|---|---|

| Annual Production (2022-23) | 59.65 BCF sales gas, 4.08 mmbbl oil, 1.22 mmboe LPG, 0.59 mmboe condensate |

|  |

Figure 10: Gas sales, 2013–14 to 2022–23 | Figure 11: Crude oil sales, 2013–14 to 2022–23 |

|  |

Figure 12: Condensate sales, 2013–14 to 2022–23 | Figure 13: LPG sales, 2013–14 to 2022–23 |

Natural hydrogen and helium exploration

Gold Hydrogen are focussing on the Yorke Peninsula and completed low impact roadside soil sampling and an extensive airborne geophysical survey over the peninsula in April 2023. Gold Hydrogen’s Ramsay 1 and Ramsay 2 drilled in October-November 2023 recorded encouraging hydrogen and helium indications from mud gas samples, consistent with hydrogen indications reported in the Ramsay Oil Bore 1 drilled in 1931 - a significant and very encouraging result for the entire natural hydrogen exploration sector. The company announced encouraging results in March 2024 at the conclusion of follow up flow testing which was completed in April.

Photo: Coiled tubing unit conducting testing at Ramsay 2, March 2024.

H2EX completed a soil gas survey in May 2023 and acquired a low impact passive seismic tomography survey in PEL 691 this year utilising Adelaide-based FleetSpace satellite technology. In 2023, H2EX was awarded a $863,000 grant to Accelerate Exploration and Extraction of Renewable Natural Hydrogen with research partners the University of Adelaide, Australian National University and Black & Veatch. H2EX conducted a low impact passive seismic tomography survey in PEL 691 utilising Adelaide-based FleetSpace satellite technology in November 2023.

Carbon capture and storage (CCS) and gas storage

South Australia has a gas storage licensing regime in place and a large endowment of onshore storage reservoirs suitable for carbon capture and storage (CCS) particularly in the depleted oil and gas fields of the Cooper Basin. Cooper and Eromanga basin oil fields are well suited to CO2 Enhanced Oil Recovery with deep reservoirs and light oil are co-located with high CO2 gas fields. Extensive datasets are available from the DEM including monthly gas production by pool, well completion reports and logs, analytical results, cores and cuttings and 2D and 3D seismic surveys.

Carbon capture and storage is enabling new technologies in the State such as low carbon hydrogen production from natural gas (‘blue hydrogen’), enhanced oil recovery, bio-energy and direct air carbon capture and storage.

South Australian based Santos Ltd, operator of the Moomba gas processing plant and gas pipeline infrastructure in the Cooper Basin, is currently constructing a CCS project at Moomba (Fig. 14). FID was taken in 2021 and the first injection is planned in 2024. Santos indicate that the injection cost is <A$30/tonne.

Figure 14. Santos JV Moomba CCS project schematic (source - Santos Ltd).

The Moomba CCS project aims to permanently store ~1.7 million tonnes/year of carbon dioxide currently vented from the Moomba gas processing plant in depleted oil and gas fields. This represents a cut of more than 7% to the state’s total greenhouse gas emissions. CO2 will be stored in high quality fluvial sandstone reservoirs in 4 way dip closed anticlines, with extensive 3D seismic coverage and multiple well intersections to reduce uncertainties. Storage capacity has been extrapolated from produced gas volumes from fields which have held natural gas and oil for 85 million years. Longer term, Cooper Basin CCS could store 20 million tonnes a year from other industrial emitters for more than 50 years. This project will be the third biggest dedicated geological storage CCS project in the world when operational (see Table 3).

Table 3. The Cooper Basin Moomba CCS project ranked against other similar projects (after Global CCS Institute 2022).

The onshore South Australian Otway Basin contains strategically located depleted gas fields, operated by Beach Energy, which have potential for re-use as underground gas storage facilities. DEM’s PSM project has also identified potential gas storage plays elsewhere in the Otway Basin. In recent years, AEMO’s yearly Gas Statement of Opportunities (GSOO) has highlighted the increasing risk of peak day gas shortfalls in the southern states due to reducing gas production from the Gippsland Basin in offshore Victoria. In order to address this gap, AEMO indicates that short and medium duration gas storage is critical to support response to peak day and seasonal demand fluctuations.

Roundtable for Oil and Gas in SA

The Roundtable for Oil and Gas Projects in South Australia was formed in 2010 and its members come from industry, governments, peak representative organisations for industry, environment protection organisations, aboriginal people, research institutions and individuals. The aim of the Roundtable is to provide a forum for members to help inform the South Australian Government on the key priorities that will underpin the Roadmap of Onshore and Offshore Oil and Gas Projects.

The last meeting was held on 24 October 2023. You are invited to attend the next meeting of the Roundtable for Oil and Gas Projects in South Australia in October 2024 at the Adelaide Convention Centre. Please register interest at DEM.Petroleum@sa.gov.au.

Regulatory compliance

The Energy Resources Act 2000 is designed as an effective, efficient and flexible regulatory system for all exploration and production activities for petroleum, gas storage and geothermal resources onshore in South Australia, as well as the construction, operation and technical regulation of high-pressure transmission pipelines. Key objects of the Act include:

- protecting the public and the environment from risks inherent in activities regulated under the Act,

- establishing appropriate consultative processes, both with people directly affected by activities regulated under the Act, and the general public, and

- ensuring appropriate levels of security of natural gas supply.

DEM prepares an annual compliance report to report on the administration of the Act and the regulatory performance of the industries covered by the Act. Current and previous compliance reports can be accessed on our website.

Photo: Director of Energy Regulation, Michael Malavazos, conducting a site inspection.