To:

Hon Dan Van Holst Pellekaan

Minister for Energy and Mining

This annual report will be presented to Parliament to meet the statutory reporting requirements of the Public Sector Act 2009 (Act) (Part 3, s12) and the Public Sector Regulations 2010 (Regulations) (Part 2, s7) and the requirements of Premier and Cabinet Circular PC013 Annual Reporting.

This report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Submitted on behalf of the DEPARTMENT FOR ENERGY AND MINING by:

Vince Duffy

Acting Chief Executive

Signed 4 October 2019

The annual report was submitted late as the final editing process identified the need to resolve inconsistencies of information contained within the report.

Department for Energy and Mining Annual Report 2018-19 (PDF 1.8 MB)

From the Chief Executive

The Department for Energy and Mining (DEM) delivers affordable, reliable and secure energy supplies in a transitioning national energy market, and responsibly unlocks the value offered by South Australia’s mineral and energy resources. The 2018-19 financial year has been a period of firsts for the Department for Energy and Mining. It was our first year as a stand-alone agency for energy and mining, the first at our new consolidated head office at Waymouth Street and our first annual report as a new agency that came into being on 1 July 2018.

Even with these many firsts, we have maintained continuity from our previous existence within larger agencies. The energy and mining divisions continue to build on a hard-earned reputation as reliable and respected industry regulators that are committed to safeguarding workplace health, safety and the environment. Our project managers and policy advisers continue to provide leadership, guidance and a commitment to deliver on the programs, legislation and regulations within our portfolio areas. Our expertise and experience helps inform other government agencies and co-regulators at a State and Commonwealth level.

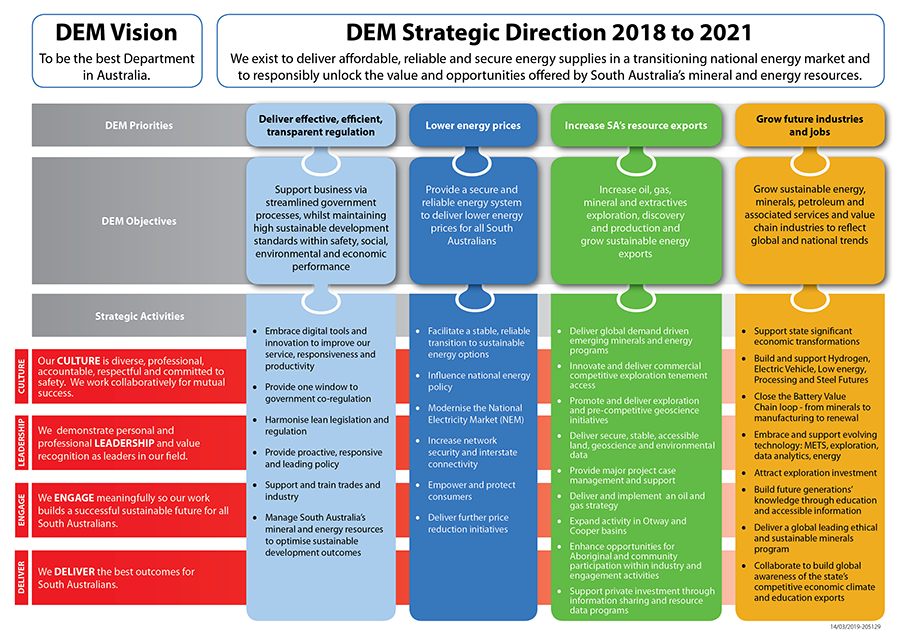

A highlight of 2018-19 was establishing a three-year Strategic Direction document that sets out our vision and key priorities: effective, efficient and transparent regulation, lower energy prices, growing resource exports and supporting future industries and jobs growth. Underpinning these four priorities are four high performance enablers: our diverse, professional, accountable and respectful culture, our demonstrable professional and personal leadership, our meaningful engagement beyond our agency to all stakeholders and our commitment to deliver the best outcomes for South Australians. Internal workshops ensured every member of our workforce had an opportunity to provide input into our foundation document.

Paul Heithersay

Chief Executive

Department for Energy and Mining

Contents

- Our strategic focus

- Our organisational structure

- Our Minister

- Our Executive team

- Legislation administered by the agency

- Performance at a glance

- Agency contribution to whole of government objectives

- Agency specific objectives and performance

- Corporate performance summary

- Employment opportunity programs

- Agency performance management and development systems

- Work health, safety and return to work programs

- Executive employment in the agency

- Risk and audit at a glance

- Fraud detected in the agency

- Strategies implemented to control and prevent fraud

- Whistle-blowers disclosure

Reporting required under any other act or regulation

Appendix 1: Consultancies and Contractors

Appendix 2: Audited financial statements 2018-19

Please refer to Appendix 2 (page 37 onwards) in the PDF version (PDF 1.8 MB) of the Annual Report

Overview: about the agency

Our strategic focus

| Our purpose | We exist to deliver affordable, reliable and secure energy supplies in a transitioning national energy market, and to responsibly unlock the value and opportunities offered by South Australia’s mineral and energy resources. |

| Our vision | Our vision is to be the best government agency in Australia. |

| Our values | Our culture is diverse, professional, accountable, respectful and committed to safety. We demonstrate personal and professional leadership and value recognition as leaders in our field. We engage meaningfully so our work builds a successful, sustainable future for all South Australians. We deliver the best outcomes for all South Australians. |

| Our functions, objectives and deliverables |

|

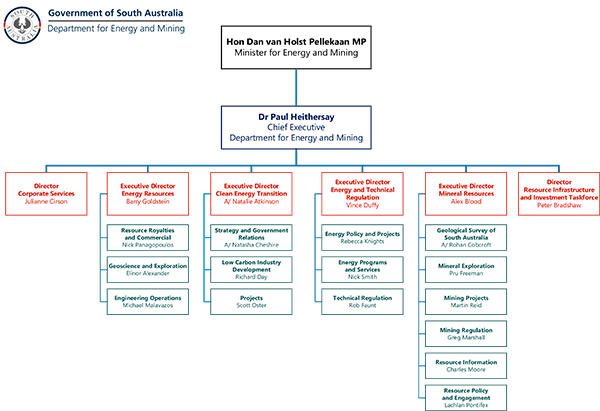

Our organisational structure

Changes to the agency

On 1 July 2018 the Governor of South Australia established by proclamation the Department for Energy and Mining as an outcome of the machinery of government changes announced by the incoming Marshall Liberal Government. The Department comprised the energy resources, mineral resources, energy and technical regulation, and energy plan implementation functions, and the Resources Investment and Infrastructure Task Force, all formerly within the Department for the Premier and Cabinet. The new department also established a corporate services division and office of the Chief Executive to support its functions as a stand-alone agency.

Our Minister

The Honourable Dan van Holst Pellekaan MP is the South Australian Minister for Energy and Mining.

The Honourable Dan van Holst Pellekaan MP is the South Australian Minister for Energy and Mining.

Minister van Holst Pellekaan was elected to Parliament as the Member for Stuart in 2010. He was promoted to the Shadow Cabinet in 2011 and has held the Energy and Mining portfolio since June 2014.

After his re-election at the 2018 State Election, he was sworn in as Minister for Energy and Mining in the Marshall Liberal Government.

Minister van Holst Pellekaan started his working life as a labourer before playing four seasons in the National Basketball League and at the same time gaining a Bachelor of Economics. He then spent ten years with BP Australia before entering the small business sector as a shareholder and operator of Outback roadhouses for seven years. This was followed by three years developing cycle tourism in the Southern Flinders Ranges immediately before entering Parliament.

Minister van Holst Pellekaan’s electorate extends from Kapunda at its southern end, all the way up to the Northern Territory border. It heads east to the Queensland and New South Wales border. It includes the Mid North agricultural region, all of the Flinders Ranges and the vast north-east pastoral region surrounded by the Northern Territory, Queensland and New South Wales. The regional city of Port Augusta is its main population centre.

Our Executive team

Dr Paul Heithersay, Chief Executive of the Department for Energy and Mining. The agency brings together the resources, energy and renewables divisions responsible for managing and regulating the State’s mineral, gas, petroleum and energy sectors on behalf of the people of South Australia.

Dr Paul Heithersay, Chief Executive of the Department for Energy and Mining. The agency brings together the resources, energy and renewables divisions responsible for managing and regulating the State’s mineral, gas, petroleum and energy sectors on behalf of the people of South Australia.

Paul joined the South Australian public service in 2002.

Natalie Atkinson, Acting Executive Director, Clean Energy Transition, leads the team responsible for major energy project delivery and industry development. Previously Natalie was the Director responsible for government relations, communications, strategy and governance for the Home Battery Scheme, Grid Scale Storage Fund, South Australia’s Virtual Power Plant and hydrogen and electric vehicle strategy development.

Natalie Atkinson, Acting Executive Director, Clean Energy Transition, leads the team responsible for major energy project delivery and industry development. Previously Natalie was the Director responsible for government relations, communications, strategy and governance for the Home Battery Scheme, Grid Scale Storage Fund, South Australia’s Virtual Power Plant and hydrogen and electric vehicle strategy development.

Alex Blood, Executive Director, Mineral Resources leads the team responsible for the provision of geoscientific data and information to support investment in mineral exploration, and for the administration and regulation of mining and mineral exploration.

Alex Blood, Executive Director, Mineral Resources leads the team responsible for the provision of geoscientific data and information to support investment in mineral exploration, and for the administration and regulation of mining and mineral exploration.

Alex is leading the development of policies to build on the State’s reputation for innovation in exploration, epitomised by the Plan for Accelerating Exploration (PACE), the South Australian Resources Information Gateway (SARIG), the South Australia Drill Core Reference Library and the Accelerated Discovery Initiative.

Peter Bradshaw, Director Resources Infrastructure and Investment Task Force, which is responsible for facilitating some of the State’s most significant transformation projects. The Task Force is focused on the South Australian government’s role in Nyrstar’s Port Pirie Transformation, the Steel Task Force and longer-term strategic projects.

Peter Bradshaw, Director Resources Infrastructure and Investment Task Force, which is responsible for facilitating some of the State’s most significant transformation projects. The Task Force is focused on the South Australian government’s role in Nyrstar’s Port Pirie Transformation, the Steel Task Force and longer-term strategic projects.

Julianne Cirson, Director Corporate Services, has led the smooth transition to the new agency. As we continue to establish key priorities including implementing organisational governance, managing Service Level Agreements for Corporate Services, modernising service delivery in response to budget savings tasks, developing and embedding the High Performing Behaviours Framework, and reviewing and implementing systems and processes to improve efficiencies.

Julianne Cirson, Director Corporate Services, has led the smooth transition to the new agency. As we continue to establish key priorities including implementing organisational governance, managing Service Level Agreements for Corporate Services, modernising service delivery in response to budget savings tasks, developing and embedding the High Performing Behaviours Framework, and reviewing and implementing systems and processes to improve efficiencies.

Vince Duffy, Executive Director, Energy and Technical Regulation division, has been at the forefront of leading and developing responses to the many challenges faced by the State during the ongoing transition in the national energy market. The division is also home to the Office of the Technical Regulator, which plays an essential role in maintaining safety in the electrical, plumbing and gas industries.

Vince Duffy, Executive Director, Energy and Technical Regulation division, has been at the forefront of leading and developing responses to the many challenges faced by the State during the ongoing transition in the national energy market. The division is also home to the Office of the Technical Regulator, which plays an essential role in maintaining safety in the electrical, plumbing and gas industries.

Barry Goldstein, Executive Director, Energy Resources division, is passionate about the energy industry and focused on the development of leading practice regulation, the direction of research and investment attraction for petroleum, geothermal energy and greenhouse gas storage. Before joining the SA Public Service, Barry had more than 30 years’ international experience in the energy business as a geologist. Barry is a recipient of an Order of Australia Public Service Medal and a Lewis G Weeks medal for outstanding contribution to petroleum exploration.

Barry Goldstein, Executive Director, Energy Resources division, is passionate about the energy industry and focused on the development of leading practice regulation, the direction of research and investment attraction for petroleum, geothermal energy and greenhouse gas storage. Before joining the SA Public Service, Barry had more than 30 years’ international experience in the energy business as a geologist. Barry is a recipient of an Order of Australia Public Service Medal and a Lewis G Weeks medal for outstanding contribution to petroleum exploration.

Legislation administered by the agency

Australian Energy Market Commission Establishment Act 2004

Broken Hill Proprietary Company’s Indenture Act 1937

Cooper Basin (Ratification) Act 1975

Electricity Act 1996

Electricity Trust of South Australia (Torrens Island Power Station) Act 1962

Energy Products (Safety and Efficiency) Act 2000

Gas Act 1997

Mines and Works Inspection Act 1920 Mining Act 1971

National Electricity (South Australia) Act 1996

National Energy Retail Law (South Australia) Act 2011

National Gas (South Australia) Act 2008

Natural Gas Authority Act 1967

Offshore Minerals Act 2000

Offshore Petroleum and Greenhouse Gas Storage Act 2006

Opal Mining Act 1995

Petroleum (Submerged Lands) Act 1982

Petroleum and Geothermal Energy Act 2000

Roxby Downs Indenture Ratification Act 1982

Stony Point (Liquids Project) Ratification Act 1981

Whyalla Steelworks Act 1958

The agency's performance

Performance at a glance

In 2018-19, the Department for Energy and Mining designed and implemented the Home Battery Scheme to support the installation of battery storage systems in 40,000 homes, led early works on the proposed New South Wales-South Australian interconnector Project EnergyConnect, and supported the State’s engagement in the Council of Australian Governments (COAG) Energy Council.

Electricity prices in South Australia fell in the 12 months to 30 June 2019. The Essential Services Commission of South Australia (ESCOSA) reported a fall in market offer prices equivalent to an average annual bill reduction of $62 for a residential customer and $141 for a small business customer. Seventy-three large energy users improved their energy costs by successfully implementing projects funded by energy productivity program grants.

The agency granted mining leases for the Kalkaroo copper and Siviour graphite projects as construction continued on the Carrapateena copper gold mine. The Steel Task Force continued to facilitate Whyalla Steelwork’s transformation, and the Resources Investment and Infrastructure Task Force led the government’s industry interaction on the Port Pirie Transformation and Olympic Dam Expansion project.

Most importantly, the agency has set up practices to ensure we can continue to drive efficiencies within our divisions that allow us to better engage and respond to our stakeholders.

Agency contribution to whole of Government objectives

| Key objective | Agency's contribution |

|---|---|

| More jobs | Grow future industries and jobs by fostering the expansion of value chain industries and professions that support the mineral, energy and renewable resources sectors. |

| Lower costs | Enable access to lower energy costs for businesses and households by facilitating clean, secure, reliable safe and a more competitive energy network. |

| Better services | Deliver effective, efficient and transparent regulation of the mineral resoures, energy resources, energy market sector and the electrical, plumbing and gas fitting professions. |

Agency specific objectives and performance

| Agency objective: Deliver effective, efficient and transparent regulation of the mineral resources, energy resources, energy market sectors and the electrical, plumbing and gas fitting professions | |

| Indicators | Performance |

|---|---|

| Transition to digital and online regulation and compliance to support business via streamlined government processes, improving efficiency and reducing cost | Finalised a Digital Transformation Strategy and Forward Plan. Completed seismic tape transcription project that will significantly reduce agency and industry data storage and management costs. Completed transition to electronic Certificates of Compliance (eCoC) portal Transitioned the ‘Regulation Roundup’ newsletter to online delivery to tradespersons across the State. |

| Effective stakeholder engagement to streamline regulatory requirements | Adapted internal audit case management and inspection booking systems to leverage efficiencies delivered by eCoC.

|

| Agency objective: Enable access to lower energy costs for businesses and households by facilitating a clean, secure, reliable, safe and more competitive energy network | |

| Indicators | Performance |

| Support the delivery of a new electricity interconnector between South Australia and New South Wales |

Government committed $14 million for early works with Project EnergyConnect granted Major Project Status in June 2019 and declared Critical State Significant Infrastructure by Government of New South Wales. ElectraNet submitted the project to the Australian Energy Regulator for formal regulatory approval. |

| Support national energy market reforms to aid an orderly and cost-effective transition to a low emissions future | Put in place regulatory instruments to implement the Retailer Reliability Obligation. |

| Empower consumers through expanded demand management options and better integration of distributed energy resources |

Led a national regulatory impact assessment process to require demand response capability for selected appliances. Submitted a rule change proposal for an in-market demand response mechanism. |

| Develop and implement initiatives to accelerate grid-scale and residential storage |

Designed and launched the Home Battery Scheme to provide $100 million in grants, supported by a $100 million Clean Energy Finance Corporation investment to provide low interest loans, for the installation of battery storage systems in up to 40,000 South Australian homes. Designed and implemented the Grid Scale Storage Fund and continued to monitor and contract manage projects supported by the Renewable Technology Fund. Supported Tesla on the implementation of the phase two trial of South Australia’s Virtual Power Plant in South Australian Housing Authority homes to deliver more affordable energy to its tenants. |

| Facilitate a stable, reliable transition to sustainable energy options |

Led the market process to establish lease arrangements for the temporary power generators. Release of market notice for government supply. |

| Agency objective: Responsibly increase South Australian exports by growing mineral, energy and renewable resources production | |

| Indicators | Performance |

| Deliver and promote exploration and precompetitive geoscience initiatives to attract new mineral exploration investment |

Supported establishment of MinEx Cooperative Research Centre to assist greenfield mineral discoveries. Announced the Accelerated Discovery Initiative to support exploration of South Australia’s untapped mineral resources to grow jobs and investment. Finalised collection of extensive pre-competitive geoscience data to inform investors and industry and support the next generation of resource industry growth in the highly-prospective Gawler Craton. |

| Develop and market Cooper-Eromanga and Otway Basin acreage releases to attract new petroleum exploration investment | New petroleum acreages in the Cooper and Otway Basins offered in May 2019 with bids closing November 2019. |

| Support ongoing delivery of projects to increase availability of locally sourced natural gas | Continued to deliver significant incremental gas supplies to the South Australian market through projects supported financially by the PACE Gas program. |

| Support the copper, magnetite and emerging mineral sector developments required for global transition to clean energy |

Supported the industry- initiated Magnetite Strategy with agreed new short-term targets. Continued cross-agency management of BHP’s Olympic Dam mining and processing operations and facilitated a proposal for the further expansion of copper production. |

| Agency objective: Grow future industries and jobs by fostering the expansion of value chain industries and professions that support the mineral, energy and renewable resources sectors | |

| Support State significant economic transformations |

The Steel Task Force continued to lead the government’s role in developing the South Australian steel industry in liaison with the Commonwealth Government. Facilitated in collaboration with the Department for Treasury and Finance the revised Port Pirie Transformation financing arrangements with Trafigura and Nyrstar. Through the Home Battery Scheme attracted sonnen, AlphaESS and Eguana Technologies to manufacture and assemble home batteries in South Australia. |

| Facilitate the development of the emerging clean hydrogen industry in South Australia |

Continued implementation of South Australia’s Hydrogen Roadmap to develop a hydrogen industry in South Australia, and contributed to the development by the CSIRO of a National Hydrogen Roadmap. Monitored progress of using hydrogen and biogas as future fuels including working closely with Australian Gas Networks on its hydrogen injection into gas mains project. |

| Enhance opportunities for local and Aboriginal participation within industry and engagement activities | Increased employment and business opportunities for Aboriginal people through development and delivery of government and industry partnerships in the Cooper and Eromanga Basins. Coordinated the achievement of improvements in engagement and cultural heritage management between exploration companies and indigenous landowners through the Stronger Partners, Stronger Futures program. |

| Integration of renewable energy generation sources into remote power stations under the Remote Area Energy Supply scheme | Upgraded power generation systems at four remote power stations in preparation for the integration of renewable power generation sources. |

Corporate performance summary

With the goal to be the best government agency in Australia the focus for the first year was to establish foundational elements required for a high-performing organisation.

Culture is at the core of creating a place where people want to work. The agency developed an Enablers and High Performing Behaviours Framework, aligned with public sector values, through an agency-wide engagement process. This Framework will grow a culture of performance and accountability to enable delivery of our Strategic Direction, and is the basis for the development and implementation of Our People Strategy.

The launch of the Strategic Direction 2018-2021, and the strategic and business planning framework articulated alignment with government priorities and provided a line of sight for employees to have clarity about how they contribute.

With a focus on creating value to our stakeholders through improved processes and innovation, the agency initiated a digital transformation strategy to consolidate and reform our existing systems and processes, and improve our capability to use data in decision making.

The agency implemented a robust governance framework incorporating its strategic, legal and ethical obligations to maintain effective governance, monitor performance, provide transparency and support decision making.

From an operational perspective, key achievements included the creation of a Diversity and Culture Committee, adopting revised business processes for handling correspondence and Freedom of Information requests, implementing a significantly improved records management system and Complaints Management System and the launch of an intranet as the primary portal for sharing corporate information and seeking across-agency collaboration.

Employment opportunity programs

| Program name | Performance |

|---|---|

| Aboriginal Traineeship Program | The agency participates in the whole-of-government Aboriginal Traineeship Program facilitated by the Office of the Commissioner for Public Sector Employment. DEM currently hosts an Aboriginal trainee in our Energy and Technical regulation division. |

| University placements | The Agency hosts students (school and university level in the fields of engineering, geology and economics) for the placement component of their course. |

Agency performance management and development systems

| Performance management and development system | Performance |

|---|---|

A Performance Management and Development (PMD) framework exists within the agency to support employees and leaders to create Performance Development Plans (PDP) and have regular performance conversations.

For reporting and monitoring purposes, all PDP discussions are recorded on a template and logged on the human resources system, HR21. | All staff are required to participate each year in two formal performance management and development review conversations. The agency had a 57 per cent completion rate between 1 July 2018 and 31 December 2018, increasing to a 61 per cent completion rate between 1 January 2019 and 30 June 2019. A review of the PMD framework began in May 2019 to streamline the process and increase engagement. The agency has engaged a contractor to develop an online performance development process to enable more effective management and reporting. |

Work health, safety and return to work programs

| Program name | Performance |

|---|---|

| Mental Health First Aid (MHFA) | In accordance with the requirement of the South Australian Modern Public Sector Enterprise Agreement: Salaried 2017, eight staff participated in accredited two-day MHFA training. This training increases mental health awareness and supports a mentally healthy culture. |

| Workplace injury claims | 2018-19 | 2017-18 | % change (+ / -) |

|---|---|---|---|

| Total new workplace injury claims | 2 | - | - |

| Fatalities | 0 | - | - |

| Seriously injured workers* | 0 | - | - |

| Significant injuries (where lost time exceeds a working week, expressed as frequency rate per 1000 FTE) | 6.60 | - | - |

* number of claimants assessed during the reporting period as having a whole person impairment of 30% or more under the Return to Work Act 2014 (Part 2 Division 5)

| Work health and safety regulations | 2018-19 | 2017-18 | % change (+ / -) |

|---|---|---|---|

| Number of notifiable incidents (Work Health and Safety Act 2012, Part 3) | 0 | - | - |

|

Number of provisional improvement, improvement and prohibition notices (Work Health and Safety Act 2012 Sections 90, 191 and 195) | 0 | - | - |

| Return to work costs** | 2018-19 | 2017-18 | % change (+ / -) |

|---|---|---|---|

| Total gross workers compensation expenditure ($) | $135,051 | - | - |

| Income support payments - gross ($) | $73,394 | - | - |

** before third party recovery

Data for previous years is available at: Not applicable - initial reporting year

Executive employment in the agency

| Executive classification | Number of executives |

|---|---|

| SAES1 | 18 |

| SAES2 | 4 |

| EXECF | 1 |

Data for previous years is available at: Not applicable - initial reporting year

The Office of the Commissioner for Public Sector Employment has a workforce information page that provides further information on the breakdown of executive gender, salary and tenure by agency.

Financial performance

Financial performance at a glance

The following is a brief summary of the overall financial position of the agency. The information is unaudited. Full audited financial statements for 2018-19 are available in Appendix 2 (page 37 onwards) in the PDF version (PDF MB) of the Annual Report

Executive summary

The agency is an administrative unit under the Public Sector Act 2009 established on 1 July 2018 and the Resources and Energy and Energy Implementation groups transferred on that date from the Department of the Premier and Cabinet (DPC).

As the agency was established on 1 July 2018, there are no prior period comparative figures available in the tables below.

Statement of comprehensive income

| 2018-19 Budget $000s | 2018-19 Actual $000s | Variation $000s | |

|---|---|---|---|

| Expenses | (184 074) | (166 301) | 17 773 |

| Revenues | 54 584 | 55 519 | 935 |

| Net cost of providing services | (129 490) | (110 782) | 18 708 |

| Net revenue from SA Government | 39 922 | 43 429 | 3 50720% |

| Net result | (89 568) | (67 353) | 22 215 |

| Total comprehensive result | (89 568) | (67 353) | 22 215 |

The agency reported a $22.215 million favourable result when compared with the 2018-19 original budget. This was mainly due to the reprofiling of initiatives, with expenditure budgets to be carried over to future years.

The agency’s major expenditure items for the year primarily related to the State’s Temporary Generators, Energy Initiative grant funding programs, and the Remote Area Energy Supply scheme. Further details on agency expenditure are disclosed in the full audited financial statements that are available in Appendix 2 (page 37 onwards) in the PDF version (PDF MB) of the Annual Report.

Statement of financial position

| 2018-19 Budget $000s | 2018-19 Actual $000s | Variation $000s | |

|---|---|---|---|

| Current positions | 5 787 | 21 531 | 15 744 |

| Non-current assets | 296 141 | 270 697 | (25 444) |

| Total assets | 301 928 | 292 228 | (9 700) |

| Current liabilities | (27 972) | (27 186) | 786 |

| Non-current liabilities | (34 447) | (15 019) | 19 428 |

| Total liabilities | (62 419) | (42 205) | 20 214 |

| Net assets | 239 509 | 250 023 | 10 514 |

| Equity | 239 509 | 250 023 | 10 514 |

Consultants disclosure

The following is a summary of external consultants that were engaged by the agency. Full details of the nature of work undertaken and actual payments made for the financial year are disclosed in Appendix 1.

| Consultants | Number | $ Actual payment |

|---|---|---|

| Below $10,000 | 8 | $35,718 |

| $10,000 or above | 20 | $2,002,265 |

| Total | 28 | $2,037,983*** |

Contractors disclosure

The following is a summary of external contractors that were engaged by the agency. Full details of the nature of work undertaken and actual payments made for the financial year are disclosed in Appendix 1.

| Contractors | Number | $ Actual payment |

|---|---|---|

| Below $10,000 | 31 | $99,064 |

| Between $10,000 and $100,000 | 27 | $1,083,735 |

| Over $100,000 | 16 | $8,675,199 |

| Total | 74 | $9,857,998*** |

Contractors include major service contract payments to Cowell Electricity Supply Pty Ltd to manage electricity infrastructure in the Remote Area Energy Supply (RAES) communities.

***Total contractor payments varies by $932,000 from the figure published in the audited financial statements due to the inclusion of payments for temporary staff.

Risk management

Risk and audit at a glance

The agency’s Risk and Performance Committee (joint with the Department for Innovation and Skills, and the Department for Trade, Tourism and Investment) has oversight of strategic risks. Strategic risks are those where the effect of an event or change in circumstances affects the ability to achieve its strategic direction. The strategic risk register articulates these risks. Internal audit reviews are consistent with these strategic risks.

Fraud detected in the agency

| Category/Nature of fraud | Number of instances |

|---|---|

| Nil | Nil |

NB: Fraud reported includes actual and reasonably suspected incidents of fraud.

Strategies implemented to control and prevent fraud

The agency employs a range of risk-based strategies to control and prevent fraud. These strategies form the agency’s Fraud Control Plan and include, but are not limited to, a related policy and procedure, segregation of duties, pre-employment screening, and declarations of interest. Appropriate business practices are also reinforced through the Financial Management Compliance Program. The Plan and related activities are overseen by the Risk and Performance Committee.

The induction process ensures that all new employees are made aware of the Code of Ethics for the South Australian Public Sector through mandatory online training.

Data for previous years is available at: N/A – Initial reporting year

Whistle-blowers disclosure

Number of occasions on which public interest information has been disclosed to a responsible officer of the agency under the Whistleblowers Protection Act 1993:

Nil

Data for previous years is available at: N/A – Initial reporting year

Reporting required under any other Act or Regulation

| Act or Regulation | Requirement |

|---|---|

| Energy Products (Safety and Efficiency) Act 2000 |

s25—Annual report (1) The Technical Regulator must, within three months after the end of each financial year, deliver to the Minister a report on the Technical Regulator's administration of this Act during that financial year. |

| Electricity Act 1996 |

s14—Annual report (1) The Technical Regulator must, within three months after the end of each financial year, deliver to the Minister a report on the Technical Regulator's operations under this Act during that financial year. |

| Gas Act 1997 |

s14—Annual report (1) The Technical Regulator must, within three months after the end of each financial year, deliver to the Minister a report on the Technical Regulator's operations during that financial year. |

| The Water Industry Act 2012 |

s13—Annual report (1) The Technical Regulator, within three months after the end of each financial year, must deliver to the Minister, a report on the Technical Regulator's operations during that financial year. |

Reporting required under the Carers’ Recognition Act 2005

Nil

Public complaints

Number of public complaints reported (as required by the Ombudsman)

| Complaint categories | Sub-categories | Example | Number of complaints 2018-19 |

|---|---|---|---|

| Professional behaviour | Staff attitude | Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile, cultural competency | 3 |

| Professional behaviour | Staff competency | Failure to action service request; poorly informed decisions; incorrect or incomplete service provided | 0 |

| Professional behaviour | Staff knowledge | Lack of service specific knowledge; incomplete or out-of-date knowledge | 0 |

| Communication | Communication quality | Inadequate, delayed or absent communication with customer | 0 |

| Communication | Confidentiality | Customer’s confidentiality or privacy not respected; information shared incorrectly | 0 |

| Service delivery | Systems/technology |

System offline; inaccessible to customer; incorrect result/information provided; poor system design | 0 |

| Service delivery | Access to services | Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities | 0 |

| Service delivery | Process |

Processing error; incorrect process used; delay in processing application; process not customer responsive | 0 |

| Policy | Policy application | Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given | 2 |

| Policy | Policy content | Policy content difficult to understand; policy unreasonable or disadvantages customer | 0 |

| Service quality | Information | Incorrect, incomplete, out dated or inadequate information; not fit for purpose | 0 |

| Service quality | Access to information | Information difficult to understand, hard to find or difficult to use; not plain English | 41 |

| Service quality | Timeliness | Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met | 0 |

| Service quality | Safety | Maintenance; personal or family safety; duty of care not shown; poor security service premises; poor cleanliness | 0 |

| Service quality | Service responsiveness | Service design doesn’t meet customer needs; poor service fit with customer expectations | 1 |

| No case to answer | No case to answer | Third party, customer misunderstanding; redirected to another agency; insufficient information to investigate | 0 |

| Total | 47 |

| Additional metrics | Total |

|---|---|

| Number of positive feedback comments | 1 |

| Number of negative feedback comments | 122 |

| Total number of feedback comments | 123 |

| % complaints resolved within policy timeframes | 100% |

Data for previous years is available at: N/A – Initial reporting year

Appendix 1: Consultancies and contractors

Consultancies with a contract value below $10,000 each

| Consultancies | Purpose | $ Actual payment |

|---|---|---|

| All consultants below $10,000 each – combined | Various | $35,718 |

Consultancies with a contract value above $10,000 each

| Consultancies | Purpose | $ Actual payment |

|---|---|---|

| Samantha Wilkinson Human Resource Consulting | Assistance in establishing a high performing culture. | $38,810 |

| Metalzoic Geological Consulting | Detailed definition of gold domains within South Australia and the development of associated geospatial products and datasets. | $62,800 |

| Ethos CRS Consulting | Collate and analyse submissions on the review of the Mining Act 1971. | $25,802 |

| PricewaterhouseCoopers | Provision of financial and commercial advice on proposals received for the Demand Management Trials program. | $94,833 |

| ACIL Allen Consulting | Energy peak demand modelling. | $41,778 |

| BDO Advisory (SA) Pty Ltd | Provision of probity advice and services to support procurement and grant funding initiatives. | $79,704 |

PricewaterhouseCoopers | Financial and commercial analysis and advice, including assistance with financial modelling, guidance on the energy industry, development of commercial strategy, support for procurement and sale processes and accounting and taxation advice. | $710,570 |

| JCHC Consulting | Strategic advice regarding the battery value chain study, 100MW battery operating protocol and hydrogen industry insights. | $24,000 |

| GPA Engineering Pty Ltd | Study of the technical standards and regulations to make the changes required to allow the injection of hydrogen into the gas network. | $124,993 |

| Greenview Strategic Consulting | Provision of energy market advice to the review of the Hornsdale Power Reserve Audit Plan and associated training services. | $18,611 |

| Brubrior Investments Pty Ltd | Assistance in the ongoing development of Olympic Dam, Steel Task Force and Nyrstar Port Pirie Smelter Transformation projects. | $210,670 |

| Gus Commercial Consulting (SA) | Commercial consultancy services including strategic advice, drafting of commercial documents and probity and procurement advice. | $44,363 |

| PPB Advisory | Review of Nyrstar Port Pirie accounts and financial model. | $75,645 |

| Robert Thomas | Expert strategic advice for projects including the roll out of the Targeted Lead Abatement Program in Port Pirie and the Dry Creek Salt Field Closure and Redevelopment Project. | $154,000 |

| CRU Group | Evaluation of the investment economics of a steel plant in Whyalla. | $85,000 |

| Fenix Performance Solutions | Financing and commercial advice relating to the Nyrstar Port Pirie Smelter Transformation. | $74,205 |

| PricewaterhouseCoopers | Provision of financial, commercial and accounting advisory service for the Whyalla Steelworks. | $46,783 |

| PricewaterhouseCoopers | Specialist advice and support relating to insolvency and financial restructuring, including conducting discussions with GFG Alliance. | $28,831 |

| Paul Case | Advise the Minister on the future of the Leigh Creek Township and chair the Leigh Creek Task Force. | $24,187 |

| Paul Case | Advise on the implementation of the government's response to the Mintabie review and chair the Mintabie Oversight Committee. | $36,680 |

| Total | $2,002,265 |

See also the Consolidated Financial Report of the Department of Treasury and Finance for total value of consultancy contracts across the South Australian Public Sector.

Contractors with a contract value below $10,000

| Contractors | Purpose | $ Actual payment |

|---|---|---|

|

All contractors below $10,000 each - combined | Various | $99,064 |

Contractors with a contract value above $10,000 each

General program management advisory services, including program oversight; project governance, procurement strategies and control and reporting structures across a range of agency projects.

| Contractors | Purpose | $ Actual payment |

|---|---|---|

| Converge International Inc. | On-site employee counselling services. | $13,833 |

| Hannan Duck & Partners Pty Ltd | Strategic advisory services relating to IT security, governance and business optimisation, KPI frameworks and customer relationship management systems for the Virtual Power Plant program. | $268,860 |

| FYB Pty Ltd | Provide Information and Records Management services. | $87,494 |

| Ramboll Australia Pty Ltd | Undertake a qualitative review and comparison of Mining Regulations and regulatory approvals. | $24,374 |

| T & P Removals Pty Ltd (Allied Pickfords) | Relocation of Minerals and Energy Resources Division from 101 Grenfell Street to 11 Waymouth Street. | $33,255 |

| Clear Decisions Trust | Project and change management support for the move to 25 Grenfell Street. | $12,240 |

| Ennovative Pty Ltd | Configuration and implementation of the Virtual Power Plant customer relationship management system. | $118,800 |

| Ramboll Australia Pty Ltd | Workshops on the rationale for aligning with Environmental and Social Impact Assessment best practice. | $29,553 |

| Proficiency Group Pty Ltd | Delivery of information and records management services. | $46,491 |

| G & S Resources Pty Ltd | Recovery and consolidation of technical data following the Leigh Creek Mine closure. | $24,000 |

| JBS&G Australia Pty Ltd | Review of the agency’s Guideline Model Environmental Outcomes. | $12,925 |

| STEM Matters | Production of a report on the history and achievements of PACE. | $29,500 |

| ARTIS Group Pty Ltd | Petroleum Exploration and Production System (PEPS) development. | $157,296 |

| SRA Information Technology Pty Ltd | ICT services relating to Tenement Management Systems. | $51,888 |

| Clifford William Mallett | Provision of expert advice and production of reports on Underground Coal Gasification. | $81,753 |

| Ausgeos Pty Ltd | Consolidation of Geophysical data for the Far North Water Allocation Plan, Transient Groundwater Model. | $129,970 |

| University of Adelaide | Development of statistical methods for establishing chemical composition of rock and soil samples. | $15,394 |

| Catherine Jane Norton | Petrophysical support for the Otway Basin petroleum systems analysis and modelling studies. | $87,220 |

| DNV GL Australia Pty Ltd | Review of stress corrosion cracking in gas transmission pipelines. | $24,008 |

| Core Energy Group | Cooper Basin and Eastern Australia gas supply cost review. | $19,500 |

| GPA Engineering Pty Ltd | Review of existing gas transmission assets to develop options for the delivery of new gas production into the existing SEA Gas Pipeline. | $29,524 |

| PricewaterhouseCoopers | Financial and commercial advice for the revised agreement between the State and Nyrstar relating to the Port Pirie Transformation financing contracts. | $27,273 |

| Anangu Pitjantjatjara Yankunytjatjara | Addressing matters relating to the Mintabie Township. | $37,800 |

| Intract Australia Pty Ltd | Completion of a scoping study for the Mintabie Township Lease Rehabilitation. | $72,480 |

| Cowell Electric Supply Pty Ltd | Remote Area Energy Supply scheme – provision of electricity generation, distribution and retail services. | $4,687,262 |

| Oak Valley (Maralinga) Store | Remote Area Energy Supply scheme – provision of electricity generation, distribution and retail services. | $84,712 |

| Yalata Community Inc. | Remote Area Energy Supply scheme – provision of electricity generation, distribution and retail services. | $86,341 |

| Common Capital Pty Ltd | Low emission verification method for electric resistance storage water heaters. | $68,990 |

| PricewaterhouseCoopers | Financial advisory services for Project EnergyConnect to deliver an energy interconnector between South Australia and New South Wales. | $173,661 |

| New South Wales Office of Environment and Heritage | Benchmark the environmental performance of buildings under the National Australian Built Environment Ratings System. | $12,872 |

| AssetVal Pty Ltd | Valuation services relating to the Remote Area Energy Supply scheme generation and distribution equipment. | $26,000 |

| Greencap – NAA Pty Ltd | Remote Area Energy Supply scheme – provision of electricity generation, distribution and retail services. | $24,930 |

| Artis Group | Energy efficiency of E3 smart appliances equipment. | $14,360 |

| Aurecon Australasia Pty Ltd | Provision of specialist and technical engineering support on projects including emergency generation and the battery value chain. | $914,855 |

| Accipitrine Pty Ltd | Provision of specialist commercial advice for energy initiatives. | $431,353 |

| Frontier Economics Pty Ltd | Support for energy policy and procurement activities including securing generation and battery storage facilities, contractual arrangements and energy market analysis and modelling. | $386,020 |

| The Oxford Comma | Strategic communications and media support. | $29,400 |

| Honjo Pty Ltd | Project management services to support the temporary power generators. | $478,412 |

| Hybrid Agency Pty Ltd | Provision of energy market advice and training services for the review of the Hornsdale Power Reserve Audit Plan. | $276,548 |

| PQ Services Pty Ltd | General program management advisory services, including program oversight; project governance, procurement strategies and control and reporting structures across a range of agency projects. | $627,788 |

| Total | $ 9,758,935 |

The details of South Australian Government-awarded contracts for goods, services, and works are displayed on the SA Tenders and Contracts website. View the agency list of contracts.

The website also provides details of across government contracts.